We stumbled upon a hilarious quote online recently and just had to share it with our Colorado Wealth Group community: “Took my own lunch to work and didn’t buy coffee today so I should be able to afford to buy a house any day now.”

Funny quote, but unless your sandwiches and brews cost several grand each, it might be best to keep enjoying your local cafes and coffeehouses.

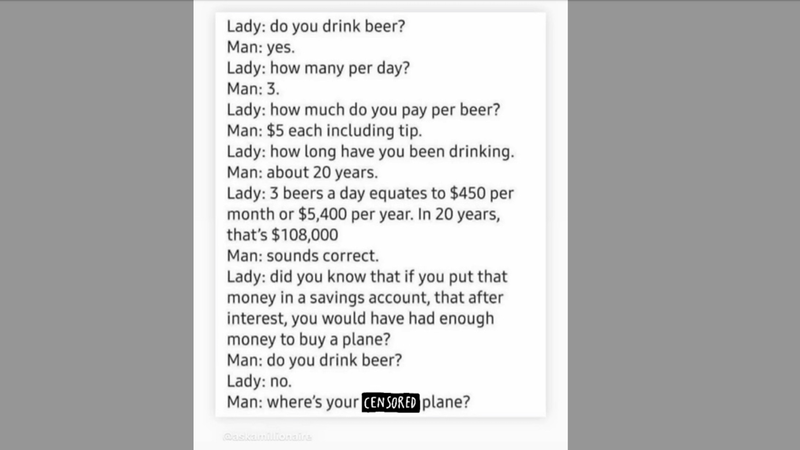

Laughed at that one? Wait until you see the next:

Where's that beachfront vacation home, right?

Isn't it counterintuitive for a wealth management group like us to chuckle at these memes?

Shouldn't we be championing frugality and more frequent investments?

Well, naturally. But here's the thing – foregoing your daily cup of joe isn't the golden ticket to riches. However, we're privy to some strategies that might be.

The Daily Brew Debacle: Fact or Fiction?

About 3 years ago, New York Times Bestselling Author David Bach wrote The Latte Factor. In this book, he explains how ditching a small luxury like a $5 latte can save you a considerable amount of money that can then be invested into something with an actual return (not just a caffeine boost).

But our take on giving up coffee? It's like asking us to surrender our mountaing views!

In all seriousness, we know the value of a well-timed caffeine kick. Interestingly, former CNBC editor and current Deputy editor at Forbes, Shawn M. Carter, felt the same way in 2018 when he wrote the article, “My daily Starbucks habit costs me $2,300 a year—here’s why I refuse to stop.”

In his article, Shawn explained how despite not having much in his savings account (on top of student loan bills and credit card balances), he wasn’t going to give up his caffeine habit to get ahead.

He concluded that if he “skipped a year of Starbucks and opted to invest the money, with compound interest, it could grow to $4,551 in 10 years assuming a 7 percent annual return, according to CNBC calculations. In 20 years, it could hit $8,952 and, in 30 years, it could reach a whopping $17,611.”

We don’t know about you, but $17K over 30 years hardly seems worth the sacrifice.

Ever wondered how many cups of coffee you'd have to skip to make a significant dent in a mortgage down payment? Spoiler: a lot!

You Can't Simply Skimp Your Way to Success

Instead of sacrificing small joys, the focus for those in their wealth-building phase should be elsewhere. It's about more impactful strategies.

1. Invest Before Indulging

We have said this before and we’ll say it again. Pay your future-self first, then use what you have leftover to buy the whole Starbucks franchise if you want to. Here’s why:

The Magic of Compounding

Compounding, often dubbed the "eighth wonder of the world" by finance aficionados, is the process where the value of an investment increases because the earnings on an investment, both from capital and previous interest, generate their own earnings.

Imagine planting a tree in your backyard that grows money instead of fruits. Initially, the tree is small and the fruits scarce. But as years go by, not only does the tree produce more money-fruits, but the fruits themselves start to sprout tiny trees around the original, and these, in turn, bear their own money-fruits. Over time, you have a garden flourishing with money trees, all stemming from that original plant.

How Compounding Works

Let’s break it down with an example:

Suppose you invest $1,000 at an annual interest rate of 7%. After the first year, you'd earn $70 in interest, giving you a total of $1,070. Now, in the second year, you'd earn interest not just on your initial $1,000, but also on the $70 interest from the first year. So, your interest for the second year would be $74.90, making your total $1,144.90. This process repeats year after year, and over a long period, even a modest initial investment can grow substantially.

The Takeaway: Invest Early and Often

This brings us to a crucial piece of advice: the earlier you start investing, the more time your investment has to compound, leading to exponentially higher gains. Let’s say, for instance, that two individuals, Jane and Joe, decide to invest in a fund yielding an average of 7% annually. Jane starts at age 25, investing $2,000 yearly for 10 years, after which she stops but leaves her money in the fund. Joe begins at age 35, investing $2,000 yearly for 30 years. By age 65, even though Joe invested for a longer period, Jane would still have more money, all thanks to the power of compounding she harnessed by starting early.

Moreover, investing regularly, rather than in sporadic lump sums, allows you to take full advantage of compounding. It's a strategy often referred to as "dollar-cost averaging", where regular investments, regardless of market highs and lows, average out the cost of investments over time and allow interest to compound on steadily increasing principal amounts.

As Colorado Wealth Group's founder Steven Harp emphasizes, "Understanding and harnessing the potential of compounding is foundational for wealth building. It's not just about the amount you invest, but how early and how consistently you do it. Prioritizing savings over momentary pleasures ensures our long-term goals remain within reach. Even the smallest contributions, when invested wisely and regularly, can snowball over time due to the magic of compounding."

2. Boost Your Earnings

There's a ceiling to how much you can reduce, but earnings have boundless potential.

Before you raise a skeptical brow, understand this: focusing on growth paves the way for innovative strategies and solutions. Rather than just minimizing expenses, emphasize maximizing opportunities.

Being growth-oriented often translates to successful business decisions too, compelling entrepreneurs to adopt innovative methods or refine existing products. Embrace this growth-centric outlook.

If you’re a W-2 employee or receive executive compensation, consider asking for a raise periodically to boost your earnings potential. Or you may even consider switching employers.

3. Replace “Budgeting” with “Cash Flow Consciousness”

Forget traditional budgeting; it's more about being conscious of your cash flow.

Understanding and monitoring where your money flows is vital.

Fostering Wise Financial Habits > Brewing Your Own Coffee

Building wealth is more intricate than merely ditching your barista. But here's a silver lining:

Building good financial habits is like building muscle. The more often you practice the good habits, the easier they get to perform. It becomes second nature. You grow as a better, more financially informed, and rational decision-making human and your portfolio has a greater potential to grow. It’s a win-win.

But, before we go, here’s one more meme to send you off with:

Life's joys and financial prudence aren’t mutually exclusive. Prioritize wise financial choices and remember, it's your wise investments that may be paying for those finer brews in your golden years.

At Colorado Wealth Group, we understand that there are tons of competing priorities vying for your income—your career, your family, your investments, your daily latte. Making financial decisions on your own isn’t easy, especially when life gets busy. There are so many choices to make, and naturally you worry about making the right one. Letting our team serve as your fiduciary can empower you to focus on what you do best and spend more time with the people you love. We are compassionate financial advisors who can take you through the complex world of financial planning. Reserve a consult with us today to discuss your opportun